|

|

|

Download the FinTech Business Guide 2024/2025

Access the new and most recent information of the Peru FinTech Index 2024. |

|

EY Law presents the FinTech Business Guide 2024/2025, prepared to provide information about the industry’s development and the main legal aspects to develop FinTech businesses in Peru, as well as an overview of the ecosystem in Mexico and Chile. “According to the EY Peru FinTech Index 2024, there are 237 active FinTechs in Peru. The upcoming start of the fourth phase of interoperability will bring new entrants such as Telcoms and BigTech into the retail payments market. Therefore, it is essential for FinTechs to remain on the outlook for regulatory trends in order to participate and leverage on new opportunities as they emerge in a timely and effective manner."

Dario Bregante

Director and leader of the Financial Regulation & FinTech area, EY Peru.

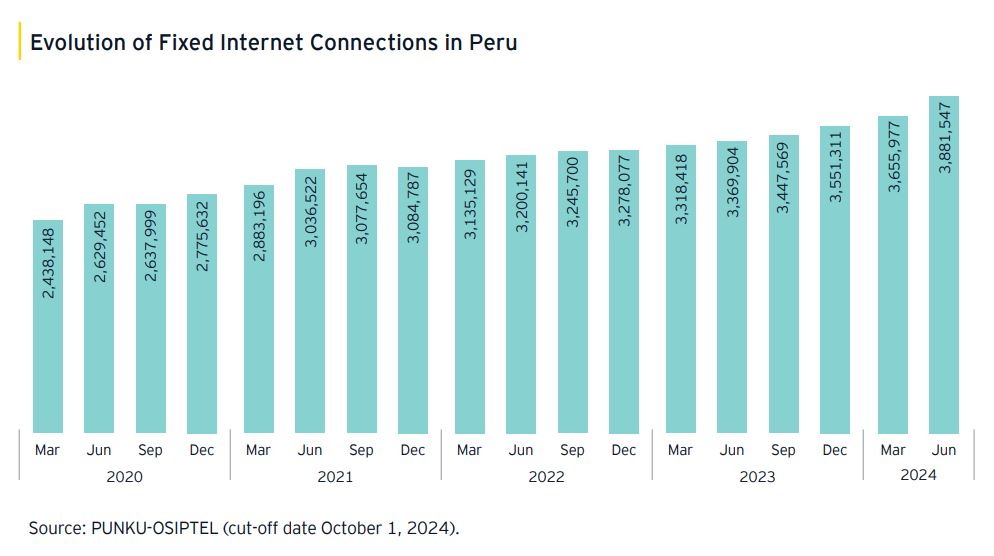

⦿ Technological and digital infrastructure

According to the OSIPTEL, in 2024,

⦿ EY Peru FinTech Index 2024:

The FinTech industry in Peru has been developing consistently. Number of FinTech companies in Peru: 237

At present, Peru registers an average annual growth of approximately 17% of the FinTech companies amount compared to last year. It is relevant to highlight that the number of Payments and Transfer FinTech companies increased to 60, surpassing the Lending vertical, which registers 54 FinTech companies. As last year, the main FinTech verticals in Peru continue to be Payments and Transfers and Lending, respectively; except that this year the Finance Management vertical has been added in third place. ⦿ Financial Inclusion Status:

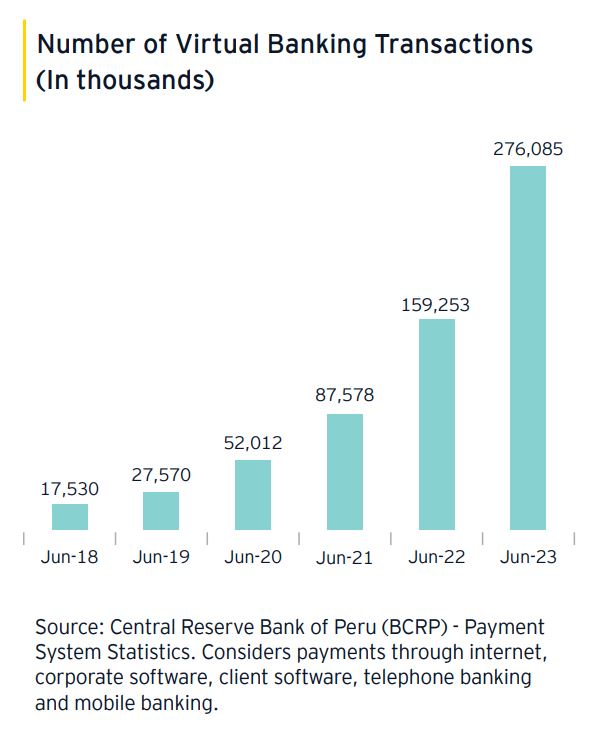

According to the report on financial inclusion indicators of the financial, insurance and

pension systems prepared by the BCRP, there has been an increase in the number of virtual banking transactions between June 2022 and June 2023. These transactions include, among others, payments made through internet, corporate software, client software, telephone banking and mobile banking.  ⦿ Digital wallets’ use and retail payments:

As of March 2024, there are more than 347 million monthly operations involving transfers between digital wallets.

Compared to March 2023, the total number of transfers made through digital wallets in March 2024 increased by 113%. The Digital Payments Indicator (DPI) has experienced an 89% increase in the number of transactions between March 2023 and the same month in 2024. The foundation of this growth is largely due to interoperability. ⦿ Most Recent Regulation on Digital Innovation and New Technologies:

⦿ The FinTech industry in the region:

|

Authors

|

Dario Bregante

Director, EY Law

|

||

|

María del Pilar Sabogal

Leader, EY Law

|